Insights

Democratizing Finance for Some: How a Strong Brand Identity Created a PR Disaster for Robinhood.

When Ted Cruz and AOC both have it out for you, you know you messed up big time. On Thursday, January 28th, a group of amateur investors from the subreddit r/WallStreetBets created chaos in the stock market.

After discovering an overleveraged short position on GameStop at the beginning of the week, the Reddit day traders drove the price of GameStop and then AMC stock to astronomical levels. In the name of “helping customers navigate this uncertainty,” Robinhood then froze and restricted trading on GameStop and several other securities. Robinhood even started automatically closing traders’ positions in GameStop, causing the price of GameStop stock to plummet early Thursday.

These dramatic steps created an unmitigated PR disaster for Robinhood, a nearly unprecedented level of online anger, and already two lawsuits. While the company’s actions were the sparks that started the fire, Robinhood’s undoing is actually the result of its actions failing to match its brand identity.

Our analysis of the online conversation around Robinhood found that the company was mentioned an average of 816 times a day on Twitter in 2020. As of 2:00 PM, January 28, Robinhood had been mentioned in 456,000 posts on Twitter, of which only 2% were positive, resulting in a staggering 1.56 BILLION impressions. Other investment platforms, including TD Ameritrade, placed similar restrictions on traders, so why was Robinhood the focus of the internet’s collective outrage?

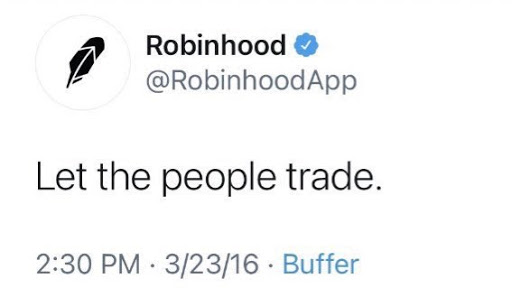

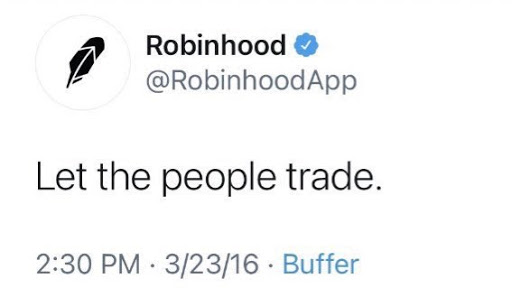

Robinhood’s Twitter bio and a single tweet from 2016 can answer that question:

Robinhood built its brand identity on“democratizing finance for all.” The company was purportedly allowing the average Joe to access the stock market just like the Wall Street elite. In an ironically titled Bloomberg article from July 2020, Robinhood Is Democratizing Markets, Not Disrupting Them, Robinhood co-CEO Baiju Bhatt is quoted saying, “People that previously didn’t feel like the markets were for them are for the first time feeling a sense of inclusivity.”

On one hand, Robinhood should be commended for developing such a strong brand identity and cementing that messaging in the minds of their customers. Creating resonant and memorable key messages is a constant PR challenge. What Robinhood just showed us is the danger of acting in a way that your stakeholders perceive as counter to your mission and brand promise.

Robinhood’s decision shut out and financially compromised the very people it was supposed to support—amateur investors who were benefitting from the markets and making truly life-changing sums of money. As such, these actions were seen by its customers and the general public as a betrayal and proof that the messages Robinhoood had worked so hard to promote were a lie.

Early in the pandemic, Robinhood experienced explosive growth, adding 3 million new users in Q1 2020 alone. Yet, the platform's accessibility and ease of use began to show a dark side. Inexperienced traders began to take big risks, and in June a 20-year old Robinhood user took his own life after thinking he had incurred hundreds of thousands in losses. This tragedy, combined with the events of this week, paints a bleak picture for Robinhood and an uphill battle for Wall Street to regain the trust of everyday investors.

Robinhood built its brand identity on“democratizing finance for all.” The company was purportedly allowing the average Joe to access the stock market just like the Wall Street elite. In an ironically titled Bloomberg article from July 2020, Robinhood Is Democratizing Markets, Not Disrupting Them, Robinhood co-CEO Baiju Bhatt is quoted saying, “People that previously didn’t feel like the markets were for them are for the first time feeling a sense of inclusivity.”

On one hand, Robinhood should be commended for developing such a strong brand identity and cementing that messaging in the minds of their customers. Creating resonant and memorable key messages is a constant PR challenge. What Robinhood just showed us is the danger of acting in a way that your stakeholders perceive as counter to your mission and brand promise.

Robinhood’s decision shut out and financially compromised the very people it was supposed to support—amateur investors who were benefitting from the markets and making truly life-changing sums of money. As such, these actions were seen by its customers and the general public as a betrayal and proof that the messages Robinhoood had worked so hard to promote were a lie.

Early in the pandemic, Robinhood experienced explosive growth, adding 3 million new users in Q1 2020 alone. Yet, the platform's accessibility and ease of use began to show a dark side. Inexperienced traders began to take big risks, and in June a 20-year old Robinhood user took his own life after thinking he had incurred hundreds of thousands in losses. This tragedy, combined with the events of this week, paints a bleak picture for Robinhood and an uphill battle for Wall Street to regain the trust of everyday investors.

Robinhood built its brand identity on“democratizing finance for all.” The company was purportedly allowing the average Joe to access the stock market just like the Wall Street elite. In an ironically titled Bloomberg article from July 2020, Robinhood Is Democratizing Markets, Not Disrupting Them, Robinhood co-CEO Baiju Bhatt is quoted saying, “People that previously didn’t feel like the markets were for them are for the first time feeling a sense of inclusivity.”

On one hand, Robinhood should be commended for developing such a strong brand identity and cementing that messaging in the minds of their customers. Creating resonant and memorable key messages is a constant PR challenge. What Robinhood just showed us is the danger of acting in a way that your stakeholders perceive as counter to your mission and brand promise.

Robinhood’s decision shut out and financially compromised the very people it was supposed to support—amateur investors who were benefitting from the markets and making truly life-changing sums of money. As such, these actions were seen by its customers and the general public as a betrayal and proof that the messages Robinhoood had worked so hard to promote were a lie.

Early in the pandemic, Robinhood experienced explosive growth, adding 3 million new users in Q1 2020 alone. Yet, the platform's accessibility and ease of use began to show a dark side. Inexperienced traders began to take big risks, and in June a 20-year old Robinhood user took his own life after thinking he had incurred hundreds of thousands in losses. This tragedy, combined with the events of this week, paints a bleak picture for Robinhood and an uphill battle for Wall Street to regain the trust of everyday investors.

Robinhood built its brand identity on“democratizing finance for all.” The company was purportedly allowing the average Joe to access the stock market just like the Wall Street elite. In an ironically titled Bloomberg article from July 2020, Robinhood Is Democratizing Markets, Not Disrupting Them, Robinhood co-CEO Baiju Bhatt is quoted saying, “People that previously didn’t feel like the markets were for them are for the first time feeling a sense of inclusivity.”

On one hand, Robinhood should be commended for developing such a strong brand identity and cementing that messaging in the minds of their customers. Creating resonant and memorable key messages is a constant PR challenge. What Robinhood just showed us is the danger of acting in a way that your stakeholders perceive as counter to your mission and brand promise.

Robinhood’s decision shut out and financially compromised the very people it was supposed to support—amateur investors who were benefitting from the markets and making truly life-changing sums of money. As such, these actions were seen by its customers and the general public as a betrayal and proof that the messages Robinhoood had worked so hard to promote were a lie.

Early in the pandemic, Robinhood experienced explosive growth, adding 3 million new users in Q1 2020 alone. Yet, the platform's accessibility and ease of use began to show a dark side. Inexperienced traders began to take big risks, and in June a 20-year old Robinhood user took his own life after thinking he had incurred hundreds of thousands in losses. This tragedy, combined with the events of this week, paints a bleak picture for Robinhood and an uphill battle for Wall Street to regain the trust of everyday investors.