Insights

Get Ready to Talk About Bitcoin.

The value of Bitcoin has increased by roughly 300% over the past six months. Household name corporations—such as PayPal, Square, and Tesla—are noted cryptocurrency devotees, and prominent analysts expect crypto to attract even greater attention over the coming years.

Essentially any company that exchanges large amounts of currency needs to be prepared to discuss cryptocurrency. As with any product this volatile and confusing, there are some simple do’s and don'ts.

DO: Acknowledge how much you don’t know

An article about cryptocurrency should probably begin with an explanation of what it is. But that’s precisely the issue: only a tiny sliver of experts and “true-believers” fully understand it and can explain it. It isn’t a means of exchange (because virtually no business accepts Bitcoin as payment) and it isn’t a store of value (because it isn’t worth anything tangible outside of what other people will pay for it).

Cryptocurrency has only been around since 2009, so we don’t know how it reacts to long-term changes in, say, interest rates or inflation in the same way we know about stocks or gold. And while many envision Bitcoin as an exchangeable currency one day, companies should admit that how and when that trend begins is pure guesswork.

Take a cue from Visa CEO Alfred Kelly, who stated he was open to crypto in an interview with CNBC, with the key caveat that any plans from Visa are “a number of years out.” Kelly won’t win any fortune-telling awards for his answer, but in being honest and circumspect, he’s expressing to Visa’s stakeholders that the company is still investigating cryptocurrency. He’s also catering to the 66% of Americans that have no interest in replacing billfolds with digital wallets just yet.

DON’T: Downplay the risk

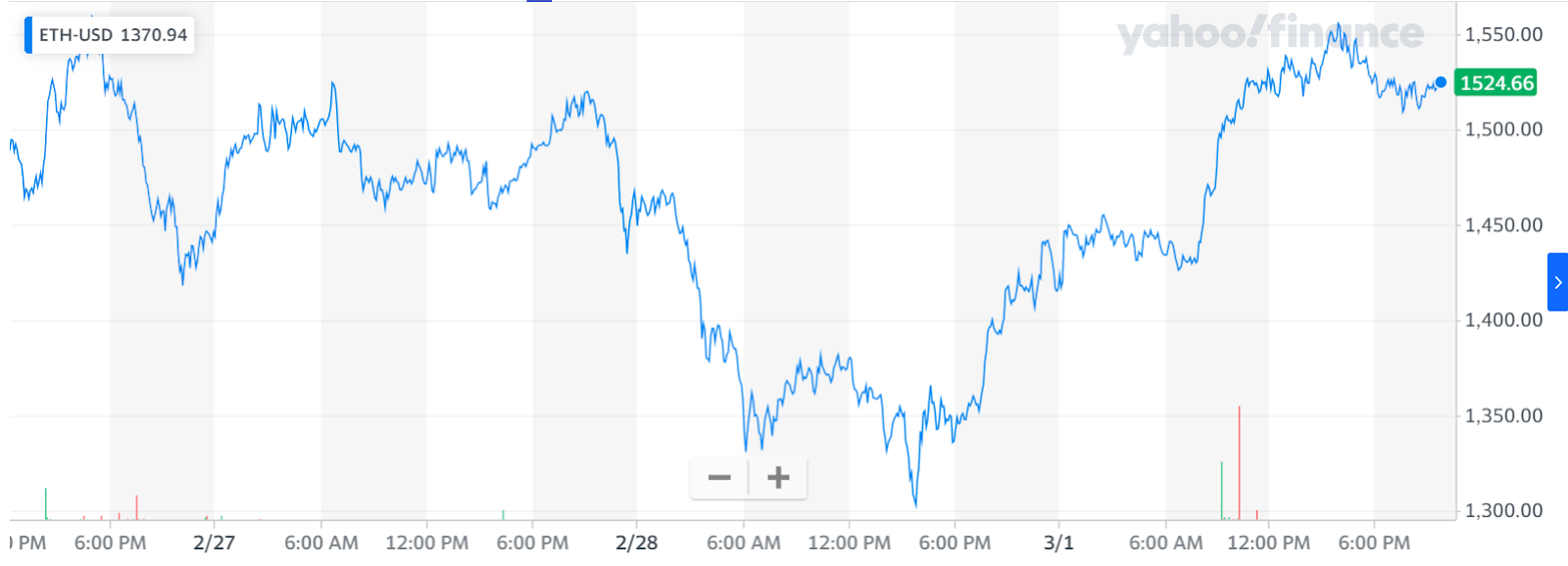

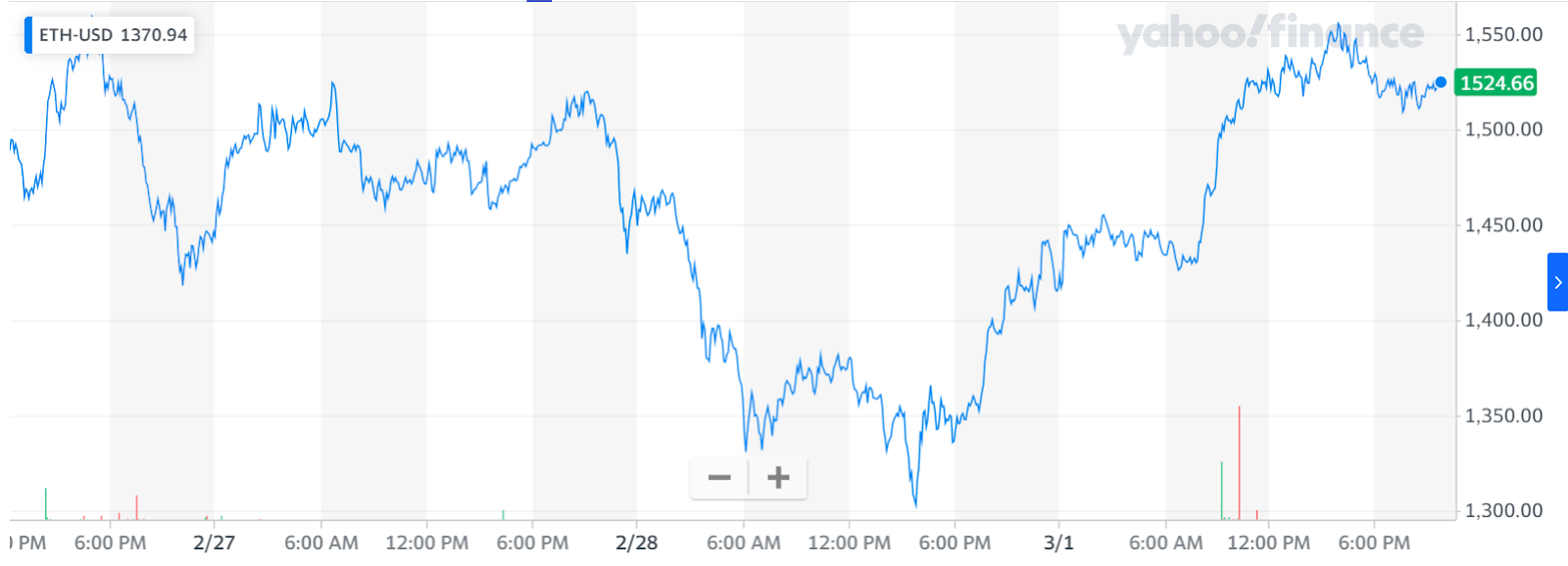

The one word every finance expert uses to describe cryptocurrency is “volatile.” Just look at Ethereum’s price chart from the last 72 hours, which resembles the EKG reading of a person who’s just been resuscitated:

Large corporations know how unpredictable these assets are, which is why so many are hesitant to invest in them or adopt them as payment. But as they begin to dip their toes in, companies—especially those in the financial services industry—have to levelset with their customers. Otherwise, they’ll open themselves up to significant criticism if crypto goes awry.

PayPal, perhaps the largest institutional champion of cryptocurrency, has a “What is crypto?” page on its mobile app that contains a whole nine sentences of information. Its “Understanding volatility and risk” page—equally brief—cloaks the rollercoaster reality of crypto in euphemisms about “innovation” and “growing pains.” A good way to attract new crypto investors? Sure. A good way to educate them? Nope. That might be fine for PayPal in the short-term, but if millions of people flood into a crypto exchange that suddenly collapses, the company’s reputation will suffer just as much as its users’ bank accounts.

DON’T: Take all media sources at their word

As communicators, we use the news as a gauge for how and when we should reach out to stakeholders about certain topics. Clients ask us what themes we’re seeing in the media or whether a blockbuster story about a competitor might affect them. But news coverage is an imperfect guide for communicating about crypto—PR professionals have to pay attention to who is saying what.

Financial media in general can suffer from sourcing bias because many investors who serve as sources have skin in the game. In the Wild West of crypto markets, sourcing bias is an even greater risk.

In this CNBC article, for instance, the first two sources we hear from work at CoinShares—a “digital asset investing” company—and BC Group—a holding company whose primary assets are “digital assets and blockchain platforms.” Axios, meanwhile, did a long-form interview with Miami Mayor Francis Suarez, who is trying to facilitate widespread adoption of crypto in South Florida. His foil in the article? Treasury Secretary Janet Yellen, who controls the traditional currency Suarez is committed to replacing.

If you want to get in the news talking about crypto, you’ll need to be either a crypto evangelist or a heretic, both of which open you up to substantial criticism from the other side. Even if you just want to track media coverage to inform your own strategies, remember that “news sources” in this space are often just people with enormous stakes in Bitcoin, attempting to advance their own agendas.

The Best Bet On Crypto

Crypto media functions in much the same way crypto itself functions. It is risky, unpredictable, and driven more by ideological commitments than market dynamics. And, much like investors in this sector, communicators should proceed cautiously.

Educate your customers and clients about crypto’s risks thoroughly, keep your options open for the future, and understand who is getting news attention and why. As far as your company’s reputation goes, sticking to those principles may not result in a Bitcoin-shaped boom, but it will insulate you from a major reputational crash.

Large corporations know how unpredictable these assets are, which is why so many are hesitant to invest in them or adopt them as payment. But as they begin to dip their toes in, companies—especially those in the financial services industry—have to levelset with their customers. Otherwise, they’ll open themselves up to significant criticism if crypto goes awry.

PayPal, perhaps the largest institutional champion of cryptocurrency, has a “What is crypto?” page on its mobile app that contains a whole nine sentences of information. Its “Understanding volatility and risk” page—equally brief—cloaks the rollercoaster reality of crypto in euphemisms about “innovation” and “growing pains.” A good way to attract new crypto investors? Sure. A good way to educate them? Nope. That might be fine for PayPal in the short-term, but if millions of people flood into a crypto exchange that suddenly collapses, the company’s reputation will suffer just as much as its users’ bank accounts.

DON’T: Take all media sources at their word

As communicators, we use the news as a gauge for how and when we should reach out to stakeholders about certain topics. Clients ask us what themes we’re seeing in the media or whether a blockbuster story about a competitor might affect them. But news coverage is an imperfect guide for communicating about crypto—PR professionals have to pay attention to who is saying what.

Financial media in general can suffer from sourcing bias because many investors who serve as sources have skin in the game. In the Wild West of crypto markets, sourcing bias is an even greater risk.

In this CNBC article, for instance, the first two sources we hear from work at CoinShares—a “digital asset investing” company—and BC Group—a holding company whose primary assets are “digital assets and blockchain platforms.” Axios, meanwhile, did a long-form interview with Miami Mayor Francis Suarez, who is trying to facilitate widespread adoption of crypto in South Florida. His foil in the article? Treasury Secretary Janet Yellen, who controls the traditional currency Suarez is committed to replacing.

If you want to get in the news talking about crypto, you’ll need to be either a crypto evangelist or a heretic, both of which open you up to substantial criticism from the other side. Even if you just want to track media coverage to inform your own strategies, remember that “news sources” in this space are often just people with enormous stakes in Bitcoin, attempting to advance their own agendas.

The Best Bet On Crypto

Crypto media functions in much the same way crypto itself functions. It is risky, unpredictable, and driven more by ideological commitments than market dynamics. And, much like investors in this sector, communicators should proceed cautiously.

Educate your customers and clients about crypto’s risks thoroughly, keep your options open for the future, and understand who is getting news attention and why. As far as your company’s reputation goes, sticking to those principles may not result in a Bitcoin-shaped boom, but it will insulate you from a major reputational crash.

Large corporations know how unpredictable these assets are, which is why so many are hesitant to invest in them or adopt them as payment. But as they begin to dip their toes in, companies—especially those in the financial services industry—have to levelset with their customers. Otherwise, they’ll open themselves up to significant criticism if crypto goes awry.

PayPal, perhaps the largest institutional champion of cryptocurrency, has a “What is crypto?” page on its mobile app that contains a whole nine sentences of information. Its “Understanding volatility and risk” page—equally brief—cloaks the rollercoaster reality of crypto in euphemisms about “innovation” and “growing pains.” A good way to attract new crypto investors? Sure. A good way to educate them? Nope. That might be fine for PayPal in the short-term, but if millions of people flood into a crypto exchange that suddenly collapses, the company’s reputation will suffer just as much as its users’ bank accounts.

DON’T: Take all media sources at their word

As communicators, we use the news as a gauge for how and when we should reach out to stakeholders about certain topics. Clients ask us what themes we’re seeing in the media or whether a blockbuster story about a competitor might affect them. But news coverage is an imperfect guide for communicating about crypto—PR professionals have to pay attention to who is saying what.

Financial media in general can suffer from sourcing bias because many investors who serve as sources have skin in the game. In the Wild West of crypto markets, sourcing bias is an even greater risk.

In this CNBC article, for instance, the first two sources we hear from work at CoinShares—a “digital asset investing” company—and BC Group—a holding company whose primary assets are “digital assets and blockchain platforms.” Axios, meanwhile, did a long-form interview with Miami Mayor Francis Suarez, who is trying to facilitate widespread adoption of crypto in South Florida. His foil in the article? Treasury Secretary Janet Yellen, who controls the traditional currency Suarez is committed to replacing.

If you want to get in the news talking about crypto, you’ll need to be either a crypto evangelist or a heretic, both of which open you up to substantial criticism from the other side. Even if you just want to track media coverage to inform your own strategies, remember that “news sources” in this space are often just people with enormous stakes in Bitcoin, attempting to advance their own agendas.

The Best Bet On Crypto

Crypto media functions in much the same way crypto itself functions. It is risky, unpredictable, and driven more by ideological commitments than market dynamics. And, much like investors in this sector, communicators should proceed cautiously.

Educate your customers and clients about crypto’s risks thoroughly, keep your options open for the future, and understand who is getting news attention and why. As far as your company’s reputation goes, sticking to those principles may not result in a Bitcoin-shaped boom, but it will insulate you from a major reputational crash.

Large corporations know how unpredictable these assets are, which is why so many are hesitant to invest in them or adopt them as payment. But as they begin to dip their toes in, companies—especially those in the financial services industry—have to levelset with their customers. Otherwise, they’ll open themselves up to significant criticism if crypto goes awry.

PayPal, perhaps the largest institutional champion of cryptocurrency, has a “What is crypto?” page on its mobile app that contains a whole nine sentences of information. Its “Understanding volatility and risk” page—equally brief—cloaks the rollercoaster reality of crypto in euphemisms about “innovation” and “growing pains.” A good way to attract new crypto investors? Sure. A good way to educate them? Nope. That might be fine for PayPal in the short-term, but if millions of people flood into a crypto exchange that suddenly collapses, the company’s reputation will suffer just as much as its users’ bank accounts.

DON’T: Take all media sources at their word

As communicators, we use the news as a gauge for how and when we should reach out to stakeholders about certain topics. Clients ask us what themes we’re seeing in the media or whether a blockbuster story about a competitor might affect them. But news coverage is an imperfect guide for communicating about crypto—PR professionals have to pay attention to who is saying what.

Financial media in general can suffer from sourcing bias because many investors who serve as sources have skin in the game. In the Wild West of crypto markets, sourcing bias is an even greater risk.

In this CNBC article, for instance, the first two sources we hear from work at CoinShares—a “digital asset investing” company—and BC Group—a holding company whose primary assets are “digital assets and blockchain platforms.” Axios, meanwhile, did a long-form interview with Miami Mayor Francis Suarez, who is trying to facilitate widespread adoption of crypto in South Florida. His foil in the article? Treasury Secretary Janet Yellen, who controls the traditional currency Suarez is committed to replacing.

If you want to get in the news talking about crypto, you’ll need to be either a crypto evangelist or a heretic, both of which open you up to substantial criticism from the other side. Even if you just want to track media coverage to inform your own strategies, remember that “news sources” in this space are often just people with enormous stakes in Bitcoin, attempting to advance their own agendas.

The Best Bet On Crypto

Crypto media functions in much the same way crypto itself functions. It is risky, unpredictable, and driven more by ideological commitments than market dynamics. And, much like investors in this sector, communicators should proceed cautiously.

Educate your customers and clients about crypto’s risks thoroughly, keep your options open for the future, and understand who is getting news attention and why. As far as your company’s reputation goes, sticking to those principles may not result in a Bitcoin-shaped boom, but it will insulate you from a major reputational crash.